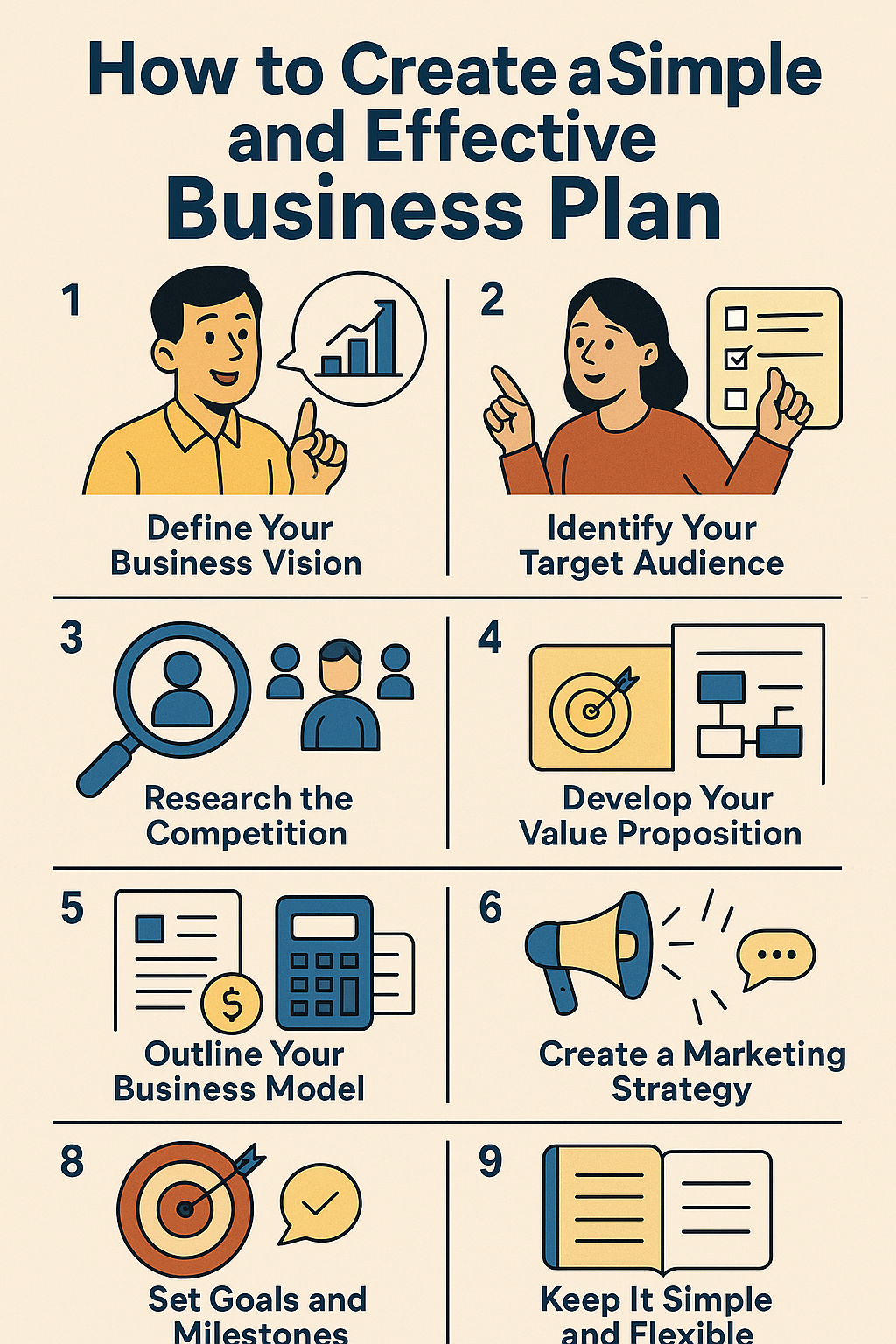

A business plan is often seen as something complex, filled with graphs, charts, and dozens of pages. But in reality, a simple and clear plan is usually more effective, especially for small entrepreneurs who are just starting out. A business plan is not only for investors—it is a roadmap for your business, guiding your decisions and keeping you focused on your goals.

In this article, we’ll break down how to create a straightforward business plan that works.

Why You Need a Business Plan

A business plan gives structure to your ideas. It allows you to:

- Clarify your goals and vision.

- Understand your target market better.

- Identify possible risks before they become problems.

- Organize finances and pricing strategies.

- Stay accountable and measure progress.

Even if you never share it with investors, having a plan helps you think like a professional entrepreneur.

Step 1: Define Your Business Vision

Start by answering simple but powerful questions:

- What problem does my business solve?

- Why does my business exist?

- Where do I want the business to be in 1, 3, and 5 years?

Example: If you are opening a bakery, your vision could be: “To provide fresh, affordable, and locally sourced baked goods that bring joy to families in the community.”

Having a vision makes it easier to stay motivated and make consistent decisions.

Step 2: Identify Your Target Audience

Knowing who your ideal customers are is crucial. Without this clarity, your marketing will miss the mark, and you may waste money.

Ask yourself:

- Who is most likely to buy my product or service?

- What are their biggest challenges or desires?

- Where do they spend time (online and offline)?

For example, if you sell affordable fitness coaching, your target audience might be young professionals who want to get in shape but don’t have time for long gym sessions.

Step 3: Research the Competition

Competitor research helps you understand what’s already working and how you can stand out.

Look at:

- Their strengths: What do they do well?

- Their weaknesses: What do customers complain about?

- Opportunities: Where can you offer something better or different?

Use tools like Google, social media, and online reviews to gather insights.

Step 4: Develop Your Value Proposition

Your value proposition is the unique reason why customers should choose you. It should be clear, concise, and customer-focused.

Formula: “I help [target audience] achieve [goal] by providing [solution].”

Example: “We help busy parents save time by delivering fresh, healthy meal kits straight to their doors.”

This statement becomes the foundation of your marketing and sales strategies.

Step 5: Outline Your Business Model

Your business model explains how you’ll make money. Ask yourself:

- What products or services will I sell?

- How will I deliver them?

- What pricing strategy will I use?

- What are my main sources of revenue?

For a small service business, you might charge hourly rates or monthly retainers. For a product-based business, you might sell directly online or through local stores.

Step 6: Organize Financial Planning

Finances can feel intimidating, but keeping it simple helps. Include:

- Startup costs: equipment, licenses, website, marketing.

- Monthly expenses: rent, software, salaries, supplies.

- Revenue goals: how much you need to sell to cover costs and make a profit.

- Break-even point: the point where revenue equals expenses.

A simple spreadsheet is enough at the beginning. The key is tracking money regularly and avoiding surprises.

Step 7: Create a Marketing Strategy

Your plan should also explain how you’ll attract and retain customers. Focus on strategies that suit your budget and target audience:

- Social media content.

- Word of mouth and referrals.

- Partnerships with other small businesses.

- Paid ads (if budget allows).

- Networking events and local promotions.

Choose 1–2 channels to focus on instead of trying everything at once.

Step 8: Set Goals and Milestones

Clear goals help you measure progress. Divide them into:

- Short-term goals (0–6 months): e.g., create a website, reach 100 customers.

- Medium-term goals (6–12 months): e.g., earn consistent monthly revenue, hire a part-time assistant.

- Long-term goals (1–3 years): e.g., expand to new locations, launch new products.

Write them down and review regularly to stay on track.

Step 9: Keep It Simple and Flexible

Your first business plan doesn’t need to be perfect or permanent. It’s a living document that should grow with your business.

- Keep it short (5–10 pages maximum).

- Use simple language—no need for complicated jargon.

- Update it as your business evolves.

Remember, your plan is there to guide you, not to limit you.

Final Thoughts: Your Roadmap to Success

Creating a business plan doesn’t have to be overwhelming. By defining your vision, audience, competition, value, finances, and goals, you build a roadmap that guides your daily decisions.

A simple and effective business plan is one of the best tools a small entrepreneur can have. It keeps you organized, focused, and ready to turn your vision into reality.

Take a few hours to write down your plan this week—you’ll be surprised how much clarity it brings to your entrepreneurial journey.